Net Present Value/NPV

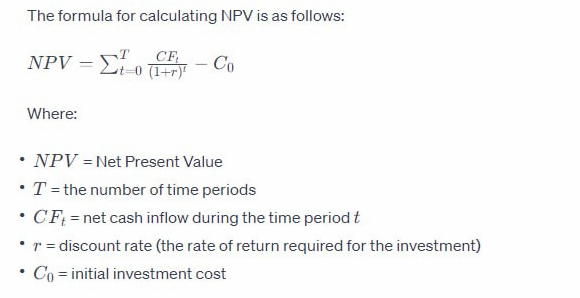

NPV stands for Net Present Value, and it is a financial metric used in capital budgeting and investment analysis. The Net Present Value represents the difference between the present value of cash inflows and the present value of cash outflows over a specific period of time. It’s a method used to evaluate the profitability of an investment or project.

Datatype: TimeSeries

=TimeSeries(“Portfolio A”, “NPV”, “1 Oct 2023”, “3 Oct 2023”, “p”, “none:none”, “Dataview(Entity, Factor, DeclarationDate, ValueDate, Unit, Value”):Both”, “ZAR”, “D”, IAAD, DataSource, Attributes)

| Entity | Factor | DeclarationDate | ValueDate | Unit | Value |

| Portfolio A | NPV | 1 Oct 2023 | 1 Oct 2023 | ZAR | 150.5 |

| Portfolio A | NPV | 2 Oct 2023 | 2 Oct 2023 | ZAR | 110.5 |

| Portfolio A | NPV | 3 Oct 2023 | 3 Oct 2023 | ZAR | 96.5 |